Sibanye-Stillwater sees strong investment appetite for green metals

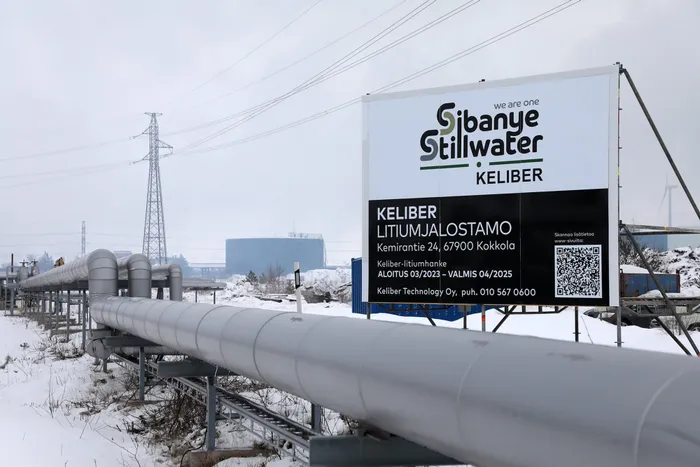

Sibanye-Stillwater is progressing with the Keliber project in Finland. Photo: Supplied

Sibanye-Stillwater says there is investment appetite towards green and battery metals such as lithium from banks and other funders although penetration rates for electric vehicles could be overstated in light of global industry headwinds that could disrupt supply and muzzle demand.

The JSE-listed precious metals miner has been making a big investment diversification into green and battery metals, especially lithium, a key component in the manufacture of electric vehicle batteries.

Sibanye-Stillwater is progressing with the Keliber project in Finland as well as the Rhyolite Ridge mine in Nevada in the US.

Rhyolite Ridge has large and shallow lithium-boron sedimentary deposits, with feasibility studies showing a mine plan of 2.5 million tons of ore mineable over 26 years as well as production of 22 000 tonnes per annum of lithium carbonate.

Yesterday, Sibanye-Stillwater, which has been roiled by tumbling platinum group metals (PGM) prices, said funding for the Nevada lithium project would come from its own $490 million (R9.2 billion) conditional equity financing as well as a $700m conditional loan from the US Department of Energy.

“We have a strong financial profile and key metrics. We know of a long list of banks that have shown interest to us. That is interest and appetite to green metals and we are confident we are able to secure the funding (for Rhyolite Ridge) early next year,” the company said during its battery metals virtual investor day presentation yesterday.

Regarding its own $490m funding for the project, Sibanye-Stillwater said it is still weighing its options. A determination will also be made depending on the company’s cash flows.

“We are looking at possibly external financing, maybe a bond or whatever it might take. We need to make sure we get the best outcome. We also see a scenario where some of that can be funded from free cash flow, maybe up to 50%.”

In Finland, the Keliber lithium mine in which Sibanye-Stillwater is investing has 16 years of planned production from five initial mining areas while the mines and concentrator facility is located about 60km from a refinery facility at the port of Kokkola.

Mika Seitovirta, Sibanye-Stillwater’s chief regional officer for Europe, said construction of the Keliber concentrator and development of the Syväjärvi open pit mine was starting in the current quarter. Keliber has a total estimated project capital of €656m (R13bn).

However, according to Sibanye-Stillwater CEO Neal Froneman, the increasing scarcity of raw materials is putting a squeeze on material stewardship, with recycling becoming very important as well as the treatment of waste and tailings.

The company was thus embracing resource stewardship through better responsible mining and environmental responsibility. Although he said prospects and uptake of battery electric vehicles was overstated, the electric vehicle market share has been growing on a quarterly basis.

“EV vehicles are estimated by the market to achieve 30% of the light duty vehicle market. In our view, the penetration rates is highly overstated,” he said.

With the PGM industry facing suppressed metal prices and labour issues turning to be worrisome, Sibanye-Stillwater still believes there is some support from green energy for some PGMs. With energy mixes shifting towards electricity, hydrogen production could emerge as a sustainer for PGM elements.

The progress made with the lithium projects, said Froneman, was positioning Sibanye-Stillwater for “significant value creation from the supply of critical green metals into an anticipated rising price environment” especially with PGMs.

Mining for lithium in Europe and the US was also improving the firm’s geopolitical positioning and expanding its revenue base from South Africa outside of South Africa.

Sibanye-Stillwater has faced problems in South Africa in recent months, especially with strike actions at its gold operations and the PGM operations also occasioning a greater need for restructuring to survive the commodity downturn.

BUSINESS REPORT