Gold prices could rise even further, toward $6,000/oz in the longer term.

Image: Freepik

Gold miners on the JSE are continuing to profit from soaring global gold prices as US President Donald Trump announces fresh tariffs on European countries.

Over the past week, gold stocks climbed almost 9%, with Gold Fields up 9.3%, according to Simply Wall Street.

Over the past five years, gold miners on the bourse have surged roughly 470%, well ahead of the broader market’s 67% gain.

The gold price itself hit a new record on Monday, rising more than 1% to above $4,670 an ounce, as investors flocked to safe-haven assets following Trump’s latest tariff announcement, Trading Economics reports.

On Saturday, Trump announced plans to impose a 10% tariff on imports from eight European countries starting next month, citing their resistance to US control over Greenland.

The rate could rise to 25% in June if no deal is reached on what he called the “complete and total purchase of Greenland”.

European leaders are expected to hold emergency talks to discuss potential retaliatory measures, including tariffs on €93 billion of US goods.

So far this year, gold has benefited from safe-haven flows amid geopolitical tensions in Venezuela and Iran, alongside renewed concerns over the Federal Reserve’s independence.

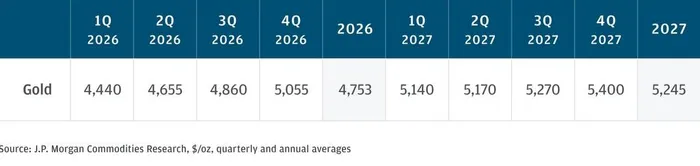

J.P. Morgan Global Research forecasts ongoing robust investor demand for gold.

Image: J.P. Morgan

Recent developments at the Federal Reserve saw the US Justice Department serve subpoenas and threaten criminal charges over Chairman Jerome Powell’s testimony on why the central bank’s headquarters refurbishment exceeded $2.5 billion.

Powell denied claims that the project had become excessively expensive when he appeared before the Senate Banking Committee last year. He has also stated, AP News reported, that the threat of criminal charges are “pretexts” to undermine the Fed’s independence when it comes to setting interest rates.

Trump and Powell have long been involved in a dispute about dropping interest rates, with the president arguing that the Fed isn’t moving quickly and deeply enough.

Last year, gold gained as much as 55%, surpassing $4,000 an ounce for the first time in October, driven by trade concerns, a weaker US dollar and strong central bank buying, JP Morgan said.

“We expect gold demand to push prices toward $5,000/oz by year-end 2026,” said Natasha Kaneva, head of Global Commodities Strategy at JP Morgan.

Prices could rise even further, toward $6,000/oz in the longer term, as supply struggles to keep pace with robust demand, Gregory Shearer, head of Base and Precious Metals Strategy at JP Morgan, said.

IOL BUSINESS

Related Topics: