A stronger rand could mean good news for consumers given that it will help keep a lid on inflation.

Image: Karen Sandison | ANA

The rand remained below R16.90 to the US dollar on Friday, boosted by upbeat global risk sentiment and a weaker greenback following recent US interest rate cuts.

This could mean good news for consumers, given that it will help keep a lid on inflation.

As of noon, the local currency was trading at R16.85, having hovered below R17 to the greenback for several weeks now.

Wichard Cilliers, head of Market Risk at TreasuryONE, attributed this to a weaker dollar. That currency was “trading flat this morning after falling yesterday in the wake of the Fed rate cut and softer jobless claims data”.

In addition, Cilliers noted that markets are winding down for the holiday season. “Risk sentiment is still upbeat, keeping risk-sensitive currencies on the front foot,” said Cilliers of the currency that had previously been notoriously volatile.

PSG Financial Services chief economist Johann Els said the Fed’s rate cut helped weaken the dollar, giving the rand a boost, while domestic improvements also supported the currency.

Els added that South Africa’s economic growth rate, which was 0.5% quarter-on-quarter, also helped the currency as this was “a little bit better than expected”.

Other benefits to the currency included a ratings upgrade by S&P, the first time the rating had been upgraded in two decades, explained Els. He added that being removed from the greylist was also beneficial.

“There's been a whole bunch of economic factors that have started helping in terms of the rand,” said Els.

A stronger rand helps lower inflation, making imports, including fuel and essential goods, cheaper. Reduced transport and production costs ease price pressures and limit the need for aggressive interest rate hikes by the South African Reserve Bank.

The local currency is benefitting from a weaker dollar.

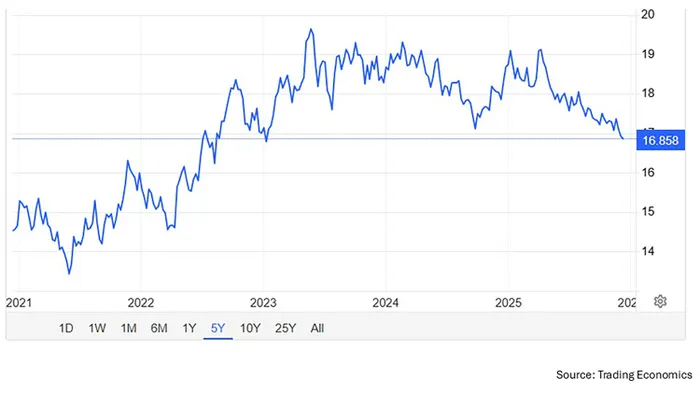

Image: Trading Economics

Conversely, a weaker rand raises import costs and consumer prices, often forcing the central bank to tighten rates to control inflation.

Nolan Wapenaar, co-investment officer at Anchor Capital, said further interest rate cuts in the US aid rand strength. “This is one of the reasons that Anchor continues to expect further gradual recovery of the rand against the greenback,” he said.

Trading Economics data show the rand is now at levels last seen in January 2023. It strengthened after the Government of National Unity was formed in May, dropping below R17 in September, and briefly breached R17 again in mid-November as market optimism over the national budget faded.

Investec chief economist Annabel Bishop said last Thursday that the rand had “continued to strengthen against the US dollar on the greenback’s weakness”.

Bishop said improvements in global risk sentiment and South Africa’s fundamentals, including fiscal consolidation and ratings upgrades, had also supported the currency.

Els said the rand could strengthen further in the short term, with medium-term stability improving as growth, fiscal health, and ratings gains continue.

“It'll still be a volatile currency because it's used by foreign investors as a proxy for the other emerging market investments. But it might be less volatile than in the past because of a lower inflation target,” said Els.

Finance Minister Enoch Godongwana announced that the inflation target would drop to 3% during the recent Medium-Term Budget Policy Statement.

IOL BUSINESS