Rand nears three-year highs as Greenland tariffs put on ice

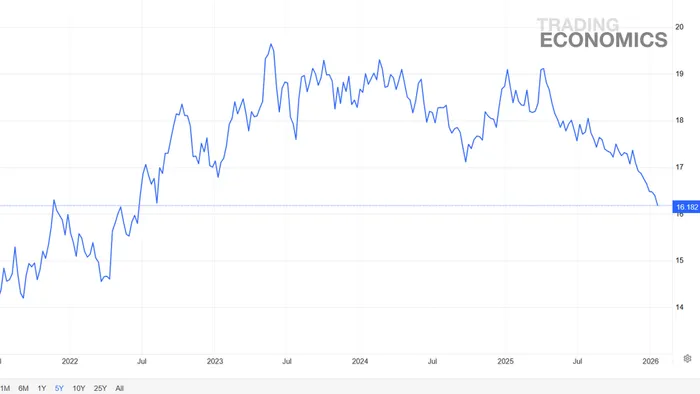

The rand strengthened sharply on Wednesday, trading around R16.18 to the greenback, near its strongest level since August 2022.

Image: Pexels.com

The rand strengthened sharply on Wednesday morning, trading around R16.18 to the greenback, near its strongest level since August 2022.

The surge came amid heightened geopolitical tensions, including US President Donald Trump ruling out the use of force to take Greenland, which fuelled a broader risk-on rally.

Independent economist Dr Roelof Botha said that the rand’s “exceptional run” offers tangible relief for households and the property market.

A stronger currency lowers the cost of imports, contains inflation, and gives the South African Reserve Bank room to reduce interest rates.

The central bank is set to meet next week with an interest rate announcement due on Thursday, although it seems unlikely rates will be cut at this meeting.

Earlier, Bloomberg reported that the rand gained 1% to R16.26 a dollar after Trump backtracked from threats of higher tariffs against European countries that don’t let him take over Greenland.

Last Saturday, Trump vowed to impose an additional set of tariffs on eight European countries, including Denmark, Sweden, France, Germany, the Netherlands, Finland, Britain and Norway, until the US can buy Greenland.

EU leaders condemned Trump’s threats of tariffs of 10% from February and rising to 25% from June unless a deal was reached, as a risk to transatlantic relations.

Tafara Tsoka, writing for Investing.com, said the currency is among the more resilient performers among emerging market currencies, strengthening steadily against the US dollar as global risk appetite improves and the greenback loses momentum.

The rand's surge comes amid heightened geopolitical tensions, including US President Donald Trump ruling out using force to take Greenland, which fuelled a broader risk-on rally.

Image: Trading Economics

“Trading near its strongest levels in months, USD/ZAR has continued a gradual but persistent decline, underscoring a shift in investor sentiment rather than a sudden reassessment of South Africa’s fundamentals,” he wrote.

Tsoka added that the move reflects broader market recalibration.

“The rand’s appreciation owes less to a sudden improvement in domestic conditions than to a change in the external environment.”

Wichard Cilliers, head of Market Risk at TreasuryONE, said that the dollar “is on the back foot amid simmering tensions between the US and Europe” over Greenland.

Globally, gold continues to attract safe-haven flows amid uncertainty, reaching a record $4,873.94 earlier Wednesday, said Cilliers.

Cilliers added that oil prices, meanwhile, edged lower amid fears that trade tensions could curb global demand.

The rand’s sustainability, analysts say, depends on global factors. Tsoka said “the sustainability of the rand’s advance will hinge on developments far beyond Pretoria”.

Tsoka also suggested that, while the rand has gained ground, a resurgence in US dollar strength or changes in US interest rates could quickly reverse recent gains.

IOL BUSINESS

Get your news on the go. Download the latest IOL App for Android and IOS now.

Related Topics: